• General

• General

Reinsurance is not an inconsequential cost. As reported in the Wall Street Journal this week, obtaining reinsurance is not a given. These reinsurers are driven by the same ESG pressures driving your own boards of directors. The WSJ article details one reinsurer's new policy to drive down the emissions of their clients by encouraging the use of leak detection technology.

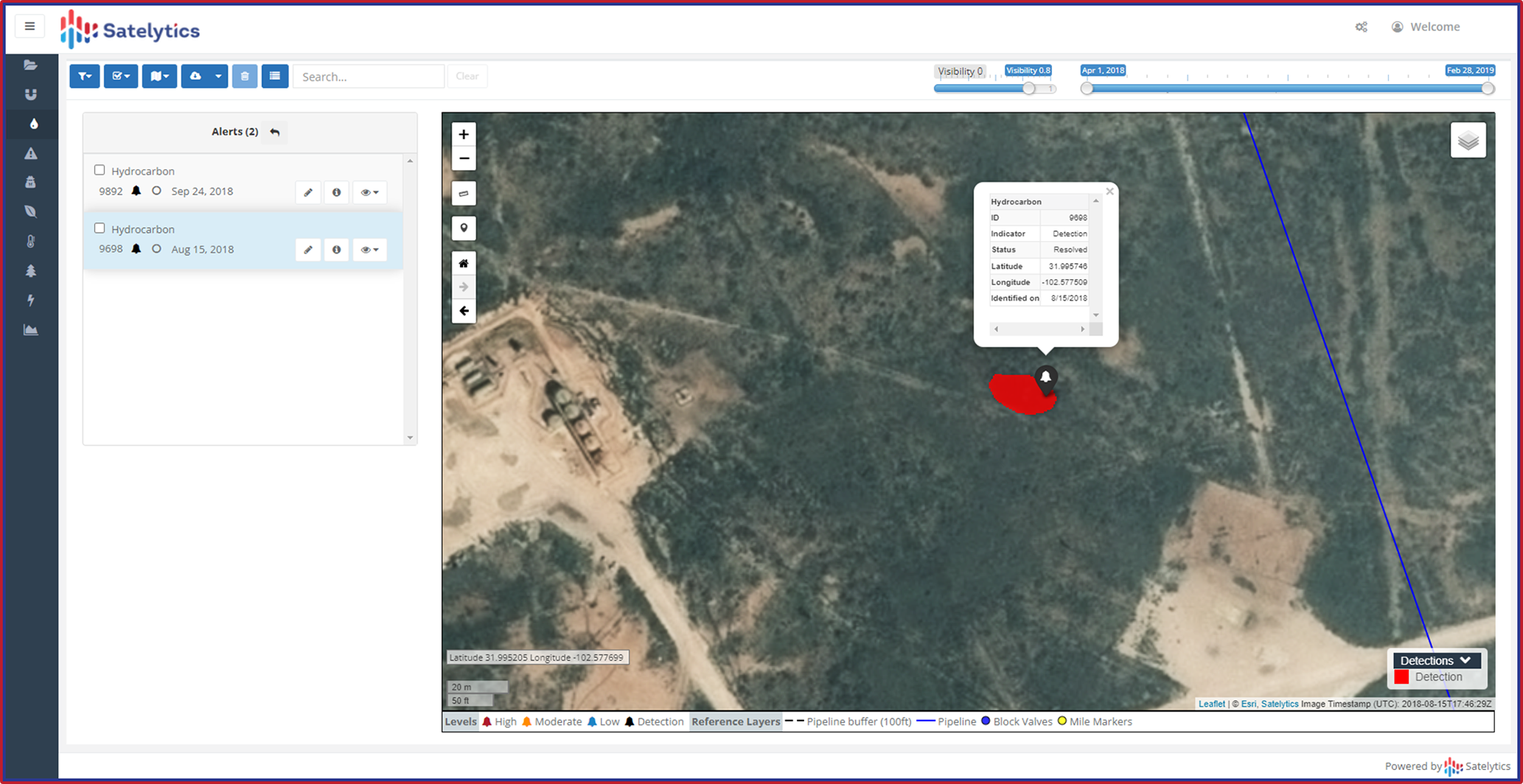

Industry is facing new demands like this from reinsurers. Satelytics provides a potential solution. Our Constant Vigilance™ algorithms monitor infrastructure and the environment, addressing business challenges – including methane and liquid leak detection – for our oil & gas, power utilities, pipeline operators, mining, and water industry customers. Satelytics' monitoring costs are offset by the significant reductions in premiums it makes possible.

One of our customers who runs a large gas operation in Colorado commented when reviewing Satelytics' options, “We drive 69 million miles per year, each mile is a risk to personnel, property, and its consequences. This is 69 million more than we wish to drive each year. Any reduction in risk most definitely has my attention.”

ESG isn't only methane... address pipeline leaks, too!

The benefits to the insured and insurers are clear.

Benefits to the Insured.

Benefits to the Insurer.

Insurers are being pressed by regulators and investors to only insure responsible companies. The same can be said for the investment business, as companies are pressured to protect the environment at all costs. Satelytics’ blend of science and software reduces risk for our customers. These types of proactive decisions in the risk arena represent an opportunity to mutually benefit our industry partners and their insurance providers.

Call us today to see how Satelytics can benefit your company.