• Oil & Gas,Electric & Gas Utilities,Pipeline Operators

• Oil & Gas,Electric & Gas Utilities,Pipeline Operators

Have you considered cost-sharing for infrastructure monitoring? You should. The economics demand it.

Excavation damage alone costs the U.S. infrastructure industry approximately $30 billion annually, with over 532,000 incidents reported in 2019. For pipeline operators specifically, third-party encroachment and excavation damage remain the leading causes of significant incidents, resulting in 136 deaths and injuries over the past decade. Yet most operators continue monitoring their assets in isolation, each bearing the full burden of surveillance costs despite sharing the same rights-of-way, utility corridors, and trenches with neighboring infrastructure.

This approach defies both logic and economics.

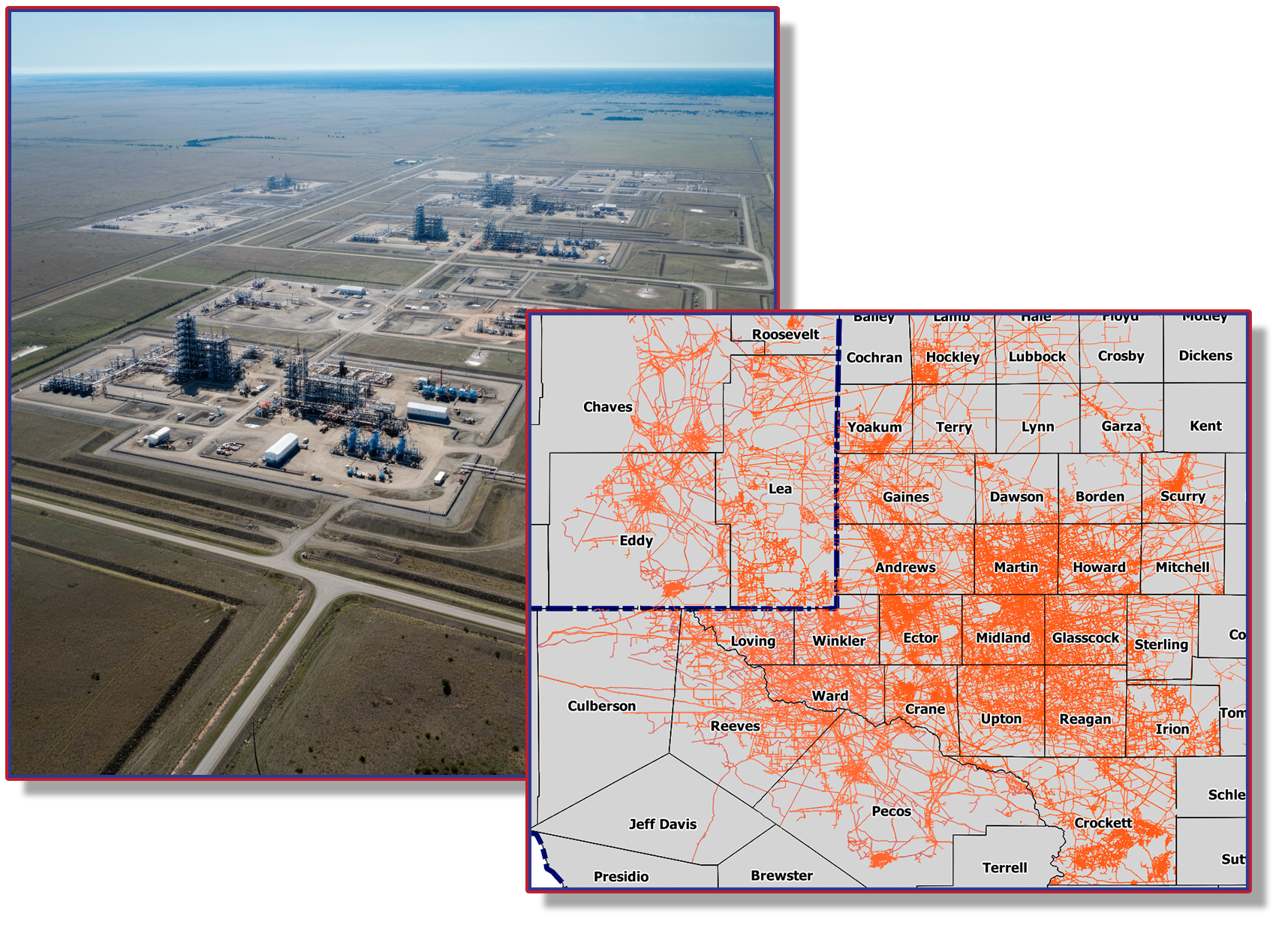

Oil and gas producers and pipeline operators work in remarkably close proximity within basins worldwide. In major U.S. oil and gas basins, neighboring pipeline assets in shared rights-of-way (ROWs) can be just feet apart. Gathering pipeline networks demonstrate extraordinary density. Individual production fields contain well pads, gathering lines, tank batteries, and gas compressors from a dozen or more operators, all interwoven within the same geographic footprint.

This infrastructure density creates a shared vulnerability. When excavation equipment encroaches on a corridor, or when geotechnical hazards threaten one segment, neighboring assets face identical risks. The energy industry spends over $3 billion annually on leak detection alone, yet each operator typically surveys only their own assets; often flying over, driving past, or imaging the same corridors their competitors monitor separately.

Overlapping assets abound in major U.S. oil & gas basins.

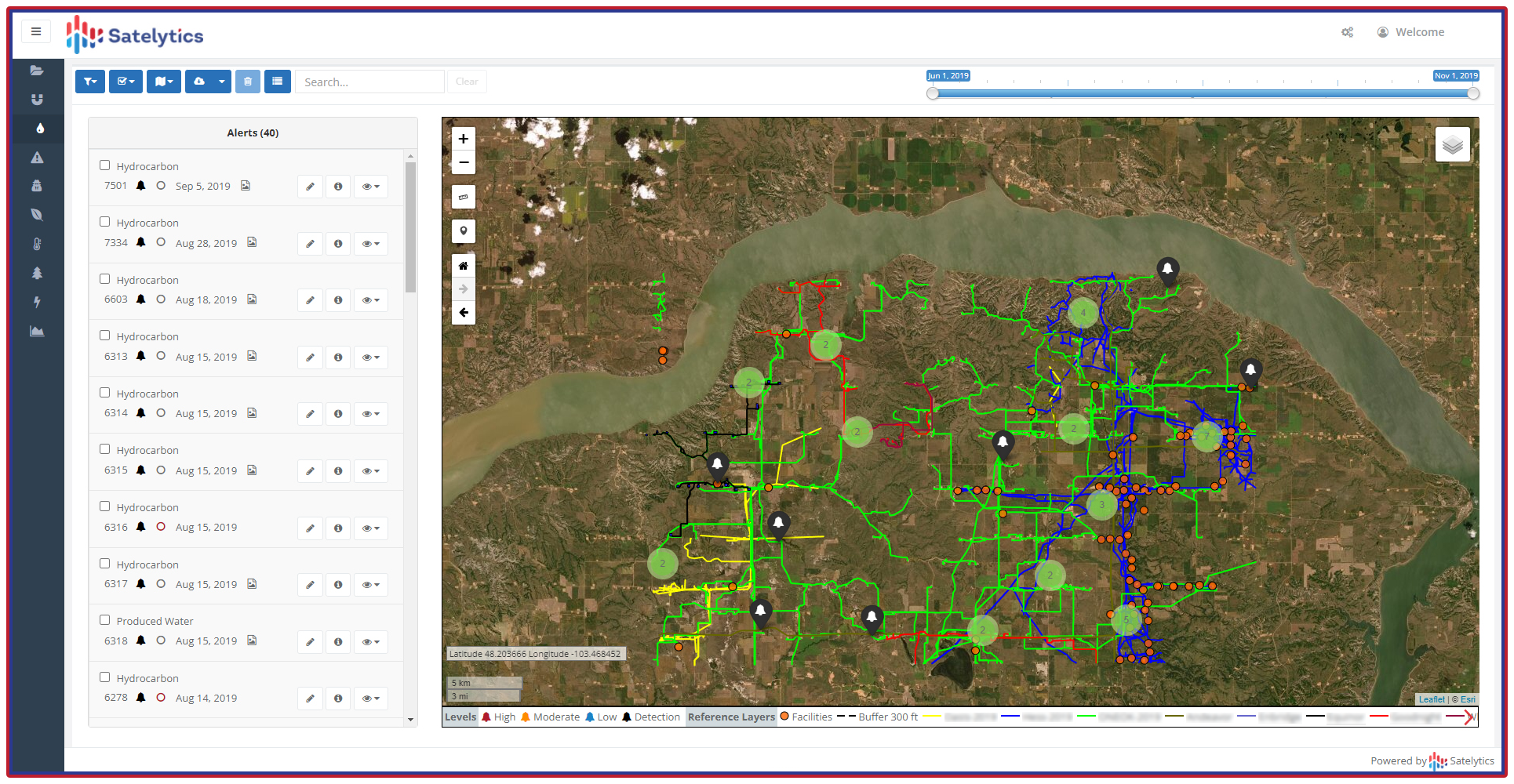

The proven success of collaborative monitoring programs demonstrates compelling economics. The intelligent Pipeline Integrity Program (iPIPE) provided the blueprint. Launched in 2018 with 12 pipeline operators, iPIPE monitored 1,300 km² in North Dakota’s Bakken field and New Mexico’s Permian Basin weekly for 3 years, identifying more than 200 hydrocarbon and produced water leaks.

Program members reported that several leaks would have remained undetected significantly longer without geospatial analytics alerts, saving millions in remediation costs and protecting company reputations. Most significantly, some member companies stated they entered with low expectations for collaboration but were surprised by the high level of cooperation. Competitors discovered they could work together effectively in non-competitive operational space.

The cost structure of satellite monitoring creates natural economies of scale. High-resolution commercial satellite imagery ranges from $5 to $30 per km², depending on resolution and tasking requirements. Satelytics leverages this imagery to quickly analyze vast areas, from 100 km² to tens of thousands of km². When 10-15 operators share monitoring costs across a common basin or corridor, individual operator costs drop dramatically while detection capabilities increase through more frequent revisit rates.

Cost-sharing delivers benefits exceeding simple arithmetic division. Infrastructure monitoring studies demonstrate that organizations implementing comprehensive monitoring programs typically achieve 50-70% reductions in unplanned outages, 20-30% decreases in troubleshooting time, and 15-25% improvements in resource utilization. These benefits multiply in collaborative programs.

Shared monitoring enables more frequent surveillance. Where individual operators might conduct monthly or quarterly surveys to manage costs, collaborative programs can achieve weekly or even daily coverage of critical corridors. This frequency proves critical: quarterly methane leak detection surveys reduce remaining emissions by 68% compared to annual surveys, though at higher per-operator costs when conducted independently. Shared programs make frequent monitoring economically viable.

The iPIPE example validates this performance multiplier effect. Weekly monitoring across 1,300 km² with 12 participants meant each operator achieved surveillance frequency impossible to justify individually while paying a fraction of standalone program costs.

Modern geospatial analytics solve the privacy paradox that historically prevented infrastructure collaboration. Using GIS shapefiles, Satelytics differentiates asset ownership and assigns alerts to respective companies for identified threats, even when assets are located just feet apart. Each operator receives only notifications relevant to their infrastructure. Corporate privacy and operational independence remain intact. Costs are shared; critical insights are not.

This capability proves essential in shared environments. Advanced satellite-based, AI-powered systems can simultaneously monitor component-level emissions, liquid pipeline leaks, right-of-way encroachments, vegetation strike threats, and other critical functions. Automated detection identifies threats within hours, enabling operators to prevent damage before incidents occur. The alternative — traditional ground patrols or individual aerial surveys — cannot match this response time at comparable costs.

Segregate results by operator. Share costs, not critical insights.

Infrastructure owners face mounting pressures: aging assets, increasing regulatory requirements, ESG scrutiny, and cost constraints. Excavation damage incidents have trended upward since 2015, while third-party encroachment remains among the major threats to pipeline systems. Simultaneously, detection technology costs have declined while capabilities have expanded dramatically.

This convergence creates a strategic inflection point. Operators who continue monitoring independently bear unnecessary costs while accepting suboptimal surveillance frequency. Those who embrace collaborative monitoring achieve superior threat detection at reduced individual cost, transforming a defensive expense into a competitive advantage.

The mental model must shift. Infrastructure owners sharing corridors face identical threats from excavation, encroachment, geotechnical hazards, and environmental conditions. These challenges respect no property boundaries or corporate divisions. Why should monitoring programs?

The transition from "monitoring our stuff" to collaborative corridor surveillance requires leadership. The PermianShield initiative, modeled on iPIPE's success, seeks to establish basin-wide monitoring across the Permian Basin with a minimum of 10 participating companies – including oil & gas operators, pipeline operators, and electric & gas utilities. This threshold creates economic feasibility for all participants while delivering comprehensive coverage.

Early participants establish program structure, define protocols, and demonstrate viability, creating momentum for broader adoption. The iPIPE experience proves that initial skepticism about competitor cooperation dissolves when companies (and their legal eagles) recognize the non-competitive nature of infrastructure monitoring and the shared benefits of enhanced threat detection.

Satelytics has developed the technical architecture to support such programs: GIS-based asset differentiation, automated alert routing, privacy-preserving data structures, and scalable monitoring across regions containing hundreds of operators. The technology challenge has been solved. The remaining barrier is organizational inertia.

Satellite monitoring of shared infrastructure corridors is not experimental — it is proven. The economics are compelling: individual operators reduce monitoring costs while improving surveillance frequency and threat detection capabilities. The technology exists today to maintain complete operational privacy while sharing program costs. The strategic advantage belongs to operators who recognize that shared geographic space demands shared monitoring solutions.

The question is no longer whether collaborative infrastructure monitoring makes sense. The question is whether your organization will lead the transition or follow it.