• General

• General

The insurance landscape for energy and utility companies has become increasingly punishing. Infrastructure insurance premiums have climbed 4.6% in early 2024 alone, while some oil and gas companies report rate increases approaching 50% annually. For organizations managing critical infrastructure like pipelines or power grids, these escalating premiums represent a significant recurring expense that directly impacts the bottom line.

The root cause is straightforward: insurance premiums are tied directly to your risk profile. The higher the probability of incidents such as leaks, spills, equipment failures, or vegetation-related outages, the higher your premiums climb. Between 2020 and 2024, pipeline incidents alone averaged 1.45 per day in 2024 and approximately 1.7 per day since 2010. These incidents resulted in nearly $9 billion in property damage, 183 fatalities, 797 injuries, and over 51,000 evacuations between 2010 and 2024. Each incident fuels the insurance industry's perception of risk and justifies premium increases.

Yet there's a powerful countermeasure gaining traction. Just as insurers offer health-conscious individuals better rates for gym memberships and wellness programs, they increasingly reward companies that demonstrably reduce operational risk through technology. Insurers recognize that businesses adopting proactive monitoring systems create measurably safer operations, resulting in fewer claims and lower liability exposure. This risk reduction translates directly into premium relief — typically between 5% and 20% for companies implementing comprehensive monitoring systems.

The challenge is that many organizations aren't capitalizing on this opportunity, either because they're unaware of the benefit or they lack the tools to convincingly demonstrate their proactive measures to underwriters and reinsurers.

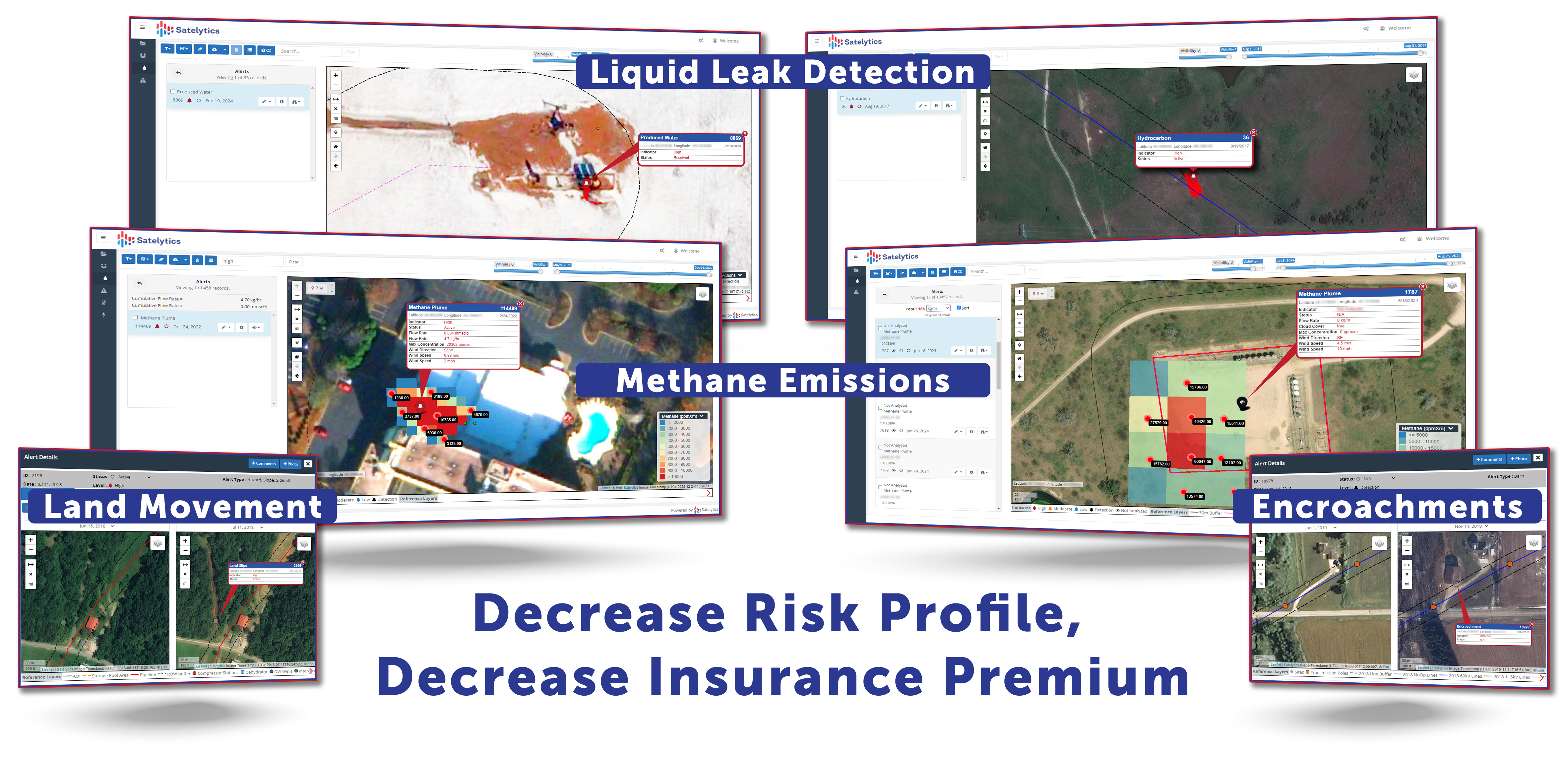

Satelytics empowers businesses to control their risk profiles with advanced geospatial analytics that deliver the kind of quantifiable results insurance underwriters understand and value. By using satellite-based spectrometry to identify and prevent issues before they escalate, companies can manage their assets more effectively while showcasing demonstrable risk reduction practices to insurers.

Consider the operational reality: our algorithms monitor vast infrastructures, including pipelines, power grids, and waterways, delivering alerts within hours of obtaining satellite data and imagery. This speed represents a fundamental shift from traditional inspection methods and has captured the attention of both insurers and reinsurers. While pipeline incidents per million barrels delivered fell 33% from 2019 to 2023, the companies achieving these improvements are those employing proactive monitoring technologies rather than relying solely on periodic manual inspections.

The financial case for geospatial monitoring becomes compelling when examined through the lens of prevention versus remediation. Facilities adopting predictive maintenance approaches (the operational cousin of geospatial monitoring) report returns on investment of 143% in the first year, with some organizations achieving ROI of 400% to 527% depending on their baseline conditions. These technologies reduce unplanned downtime by 30% to 50% and cut repair costs by approximately 50% annually by converting emergency repairs into planned maintenance. For vegetation management specifically, utilities implementing integrated strategies supported by geospatial data report annual cost savings of 21.7% and a 74.1% return on investment, along with 30% reductions in outages.

When reinsurers and primary insurers recognize your commitment to reducing risks with technology like Satelytics, they see your business as a demonstrably lower liability. This perception directly translates to measurable financial incentives.

The advantages of implementing geospatial analytics transcend immediate financial incentives. Deploying this technology demonstrates to regulators, investors, and the public that your company actively invests in safety and environmental stewardship. In an era when insurance costs are influenced by everything from climate change to regulatory compliance, this positioning strengthens both your operation and your reputation.

The insurance industry itself is undergoing a transformation, with 77% of insurance companies now adopting artificial intelligence and advanced data analytics across their value chains, a dramatic jump from 61% just one year prior. This technological evolution means insurers are becoming increasingly sophisticated at recognizing and rewarding data-driven risk management. Insurance companies utilizing advanced geospatial and location intelligence technology can offer more granular risk assessments and more competitive premiums to customers who demonstrate lower risk profiles. You benefit when you meet insurers on this data-driven terrain with evidence of proactive monitoring.

The operational benefits compound the insurance savings. Companies employing advanced leak detection and monitoring report cutting downtime and repair costs by up to 50%, reducing equipment failures by 30% to 45%, and extending asset lifespan by 20%. These improvements create a virtuous cycle: better asset management leads to fewer incidents, which generates data that demonstrates reduced risk, which in turn supports lower insurance premiums and improved access to coverage.

The value proposition creates benefits across the entire stakeholder ecosystem:

The natural gas pipeline construction cost alone averages $7.65 million per mile, representing enormous capital investment that requires protection. When you consider that integrated vegetation management on rights-of-way can prevent the nearly $120 billion in annual power outage costs attributed to inadequate vegetation control, and that the Energy Policy Act of 2005 levies fines of $1 million per day per outage, the case for proactive monitoring becomes unassailable.

If your company hasn't yet discussed geospatial analytics with your insurers and reinsurers, you're likely leaving substantial money on the table. Insurance premiums have risen an average of 8.7% faster than inflation since 2019, and this trend shows no signs of reversing. Meanwhile, the insurance industry is actively seeking companies that demonstrate quantifiable risk reduction through technology adoption. The gap between what you're currently paying and what you could be paying with demonstrated proactive monitoring may amount to hundreds of thousands or millions of dollars annually—funds that could be redirected toward growth, infrastructure improvements, or competitive advantage.

Contact Satelytics today to learn how our geospatial analytics platform can help you showcase proactive risk management to insurers, secure meaningful premium reductions, and fortify your operations with real-time monitoring that delivers alerts within hours rather than days or weeks. In an environment where insurance costs continue their relentless climb, the companies that thrive will be those that transform risk management from a reactive cost center into a proactive value driver.